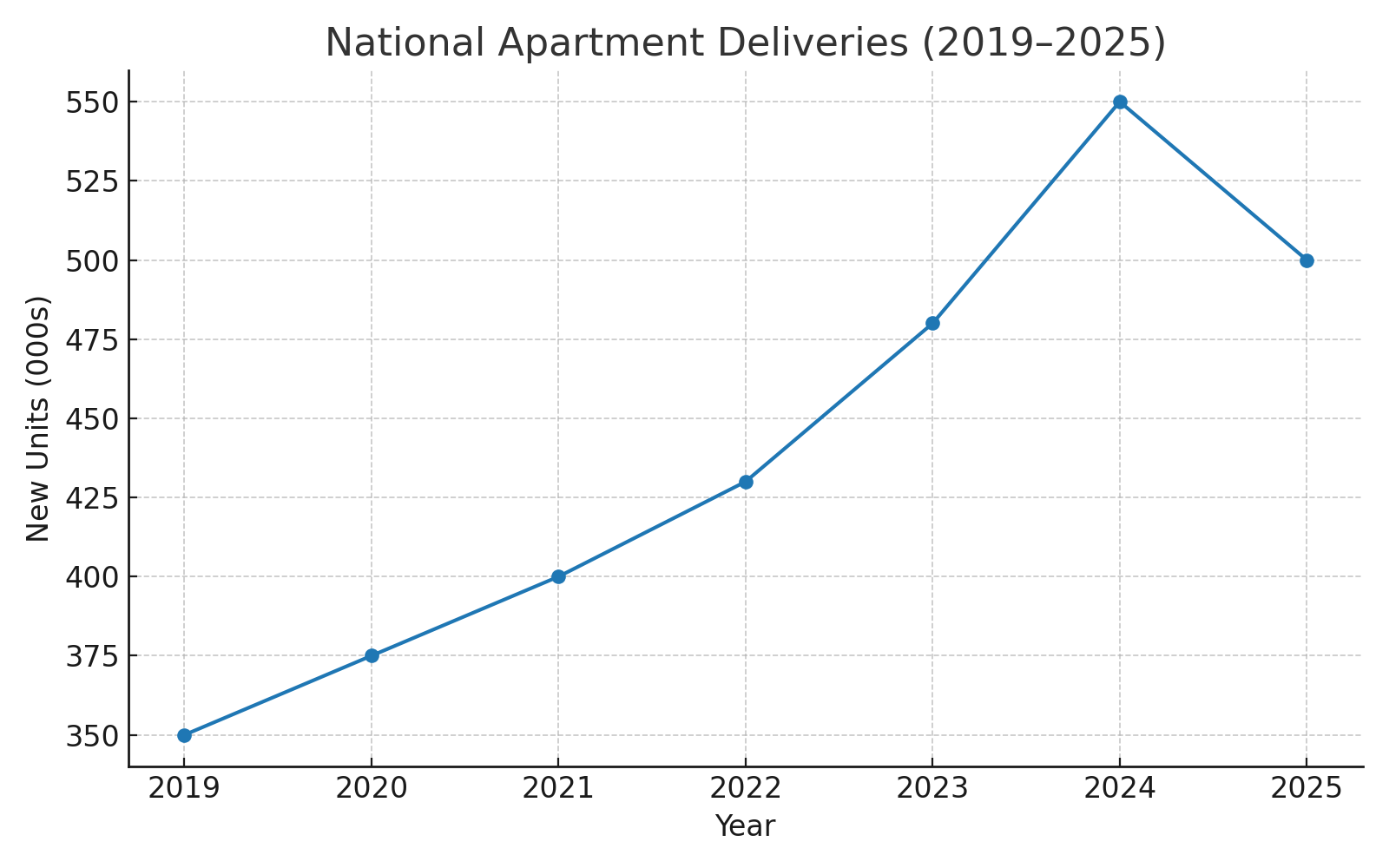

Apartment construction in the United States is expected to remain robust in 2025, with more than 500,000 new units anticipated across the country, according to Yardi Matrix data (via RentCafe). That’s a slight step down from last year’s peak, but still represents one of the strongest development cycles in recent memory.

As shown in the chart below, new deliveries are running at historically high levels, even after moderating from the record pace of 2024.

Why the South Is Attracting Development

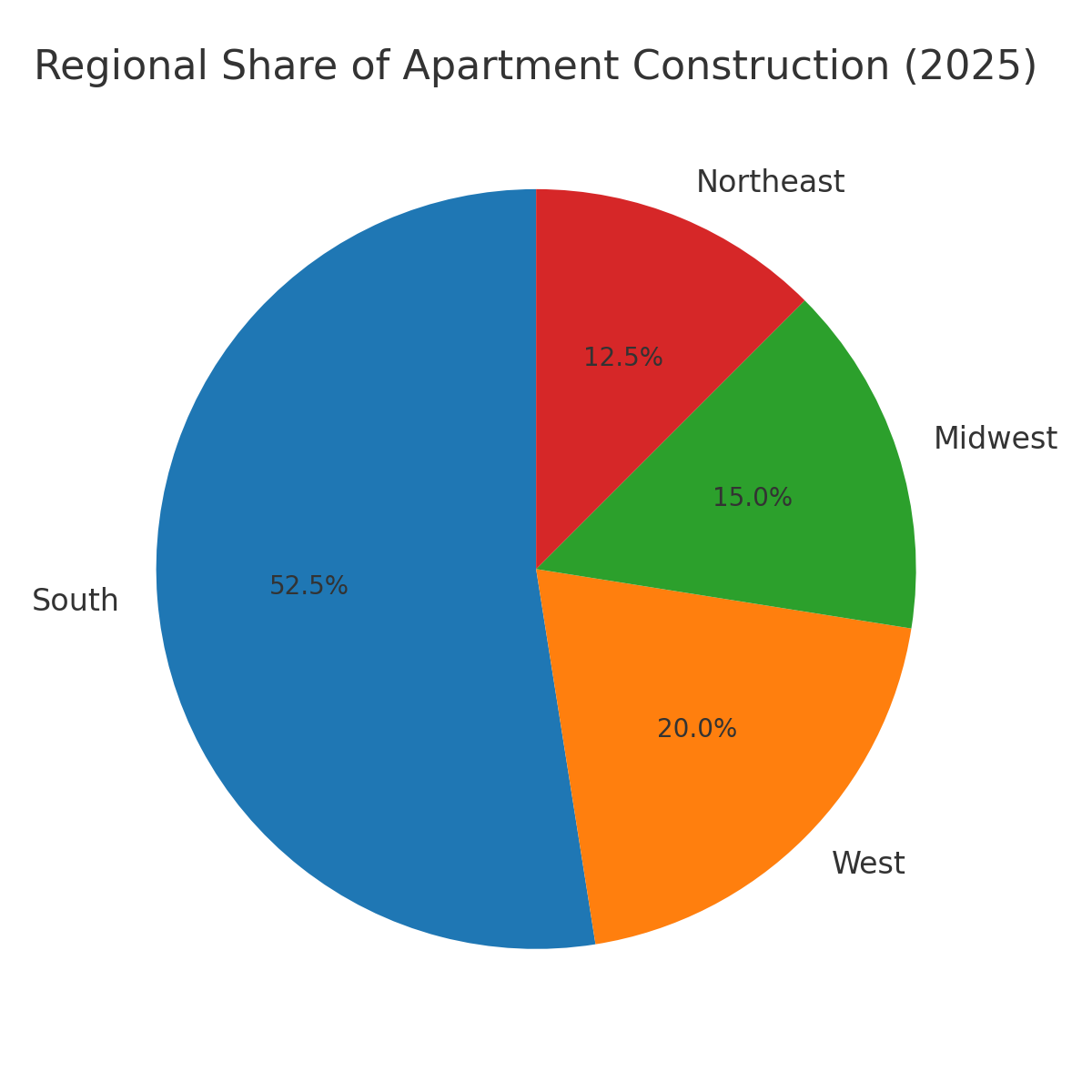

The defining story of 2025 is where these units are being built. More than half of all new supply is located in the South, with Yardi Matrix data showing the region accounts for over 52% of US deliveries. Several forces are driving this shift:

- Migration and population growth – Southern states continue to attract residents from higher-cost coastal markets, fueling housing demand.

- Relative affordability – Land, construction, and operating costs are lower compared with many Northeastern and Western metros, allowing projects to underwrite more efficiently.

- Supportive policies – Pro-development zoning and permitting environments in many Southern municipalities make it easier to bring projects online.

- Economic expansion – Corporate relocations and expansions across Texas, Florida, Georgia, and the Carolinas are creating jobs that support multifamily absorption.

The regional distribution is clearly evident in the chart below, with the South accounting for the majority of new units.

Markets Showing Strong Momentum

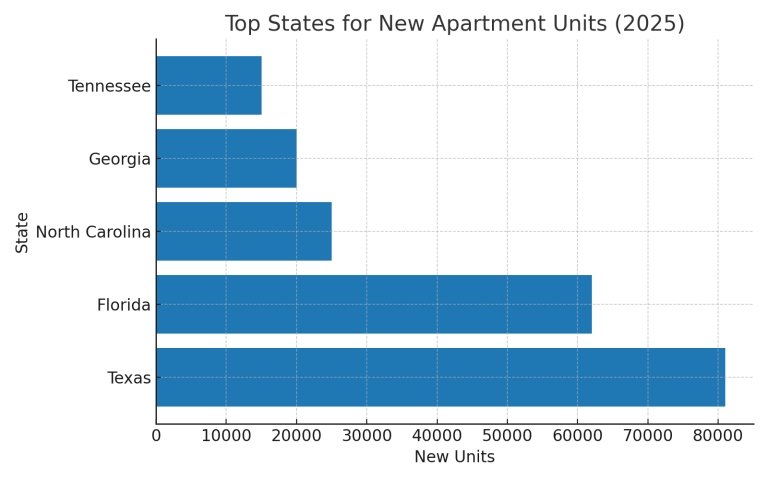

Texas and Florida are leading the way in absolute numbers, with Texas expected to deliver more than 81,000 units and Florida more than 62,000 in 2025. North Carolina, Georgia, and Tennessee also post significant pipelines, reflecting both population inflows and employer expansion.

The chart below highlights the states with the largest 2025 pipelines.

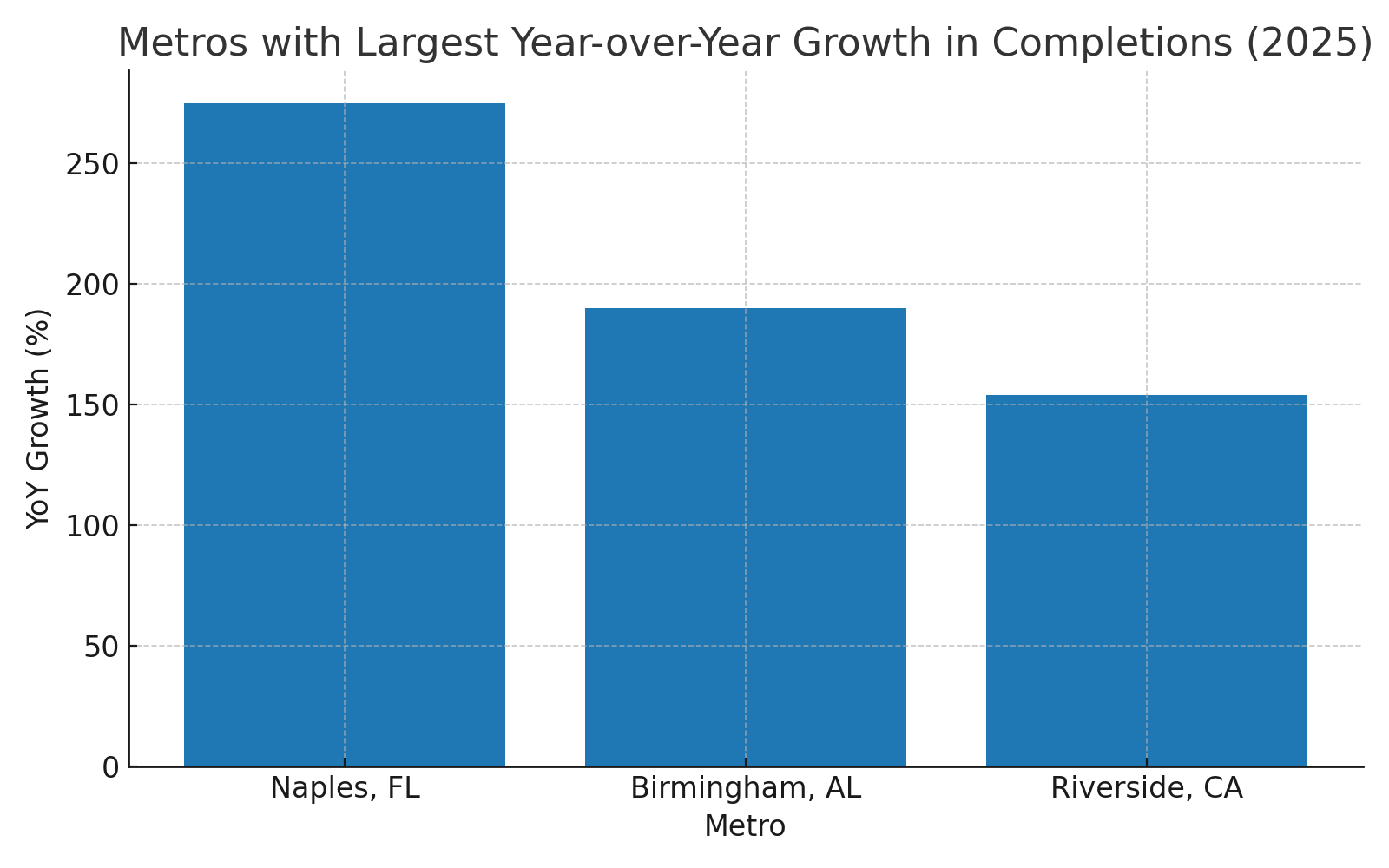

Importantly, growth is not limited to the largest metropolitan areas. Smaller and mid-sized cities are also showing dramatic increases:

- Naples, FL has seen a 275% year-over-year increase in completions, fueled by spillover from more expensive Florida markets.

- Birmingham, AL has nearly tripled its output, supported by downtown revitalization and growth in healthcare and technology.

- Riverside, CA posted a 154% increase as affordability pressures push households inland from coastal California.

The following chart highlights metros posting the most significant year-over-year growth in completions.

Divergence Across the Country

Not every region is on the same trajectory. Several historically strong apartment markets are seeing sharp pullbacks:

- Chicago: Deliveries down more than 60% year-over-year

- Minneapolis–St. Paul: Down 56%

- Portland, OR: Down 53%

- San Francisco, CA: Down 51%

These metros face a combination of cost pressures, slower population growth, and regulatory uncertainty. For lenders and investors, the takeaway is that multifamily is not a monolith—the outlook varies widely by geography.

Capital Markets Implications

For borrowers, the concentration of construction in the South has both advantages and challenges:

- Financing appetite remains strong: Lenders remain active in high-growth Southern metros, where fundamentals support long-term demand.

- But underwriting is cautious: With large supply pipelines, absorption risk is a top concern. Sponsors must show realistic lease-up assumptions and credible operating plans.

- Permanent capital outlook: Once stabilized, multifamily properties in these growth markets are expected to remain attractive to agencies, life companies, and CMBS lenders. Properties that stumble during lease-up, however, may face refinancing headwinds.

For equity providers, the same applies: long-term fundamentals are favorable, but timing and submarket selection matter.

Looking Ahead

The 2025 cycle is not just about the volume of new multifamily supply being built, but where it is being built. The South’s dominance, along with surging growth in smaller metropolitan areas, underscores a broader realignment in US housing development.

For developers, opportunities are abundant, but capital providers are selective. Lenders want clarity on tenant demand, competitive positioning, and absorption plans before committing to new construction.

At i95 Capital, we help developers and owners navigate these dynamics by structuring financing that balances opportunity with risk, whether through construction debt, bridge financing, or permanent takeouts at stabilization.